Hey Copper Community! Let’s look at how Venture Capitalist firms can benefit from using multiple pipelines in Copper.

All too often we see VC firms utilizing only one pipeline to manage all of their active relationships. If a firm is tracking more than one type of relationship, using a single pipeline may result in a lack of visibility into how the team is progressing across opportunities. If this is you, it may be time to consider leveraging multiple pipelines.

Typically, a VC firm is tracking three main relationships (or more depending on size). Instead of using custom fields or tags to distinguish one potential deal from the other, we recommend multiple pipelines to achieve the visibility you need. This not only leads to easier reporting, but it also centralizes the different data into specific journeys, making it easy to keep team members in the loop with potential investments.

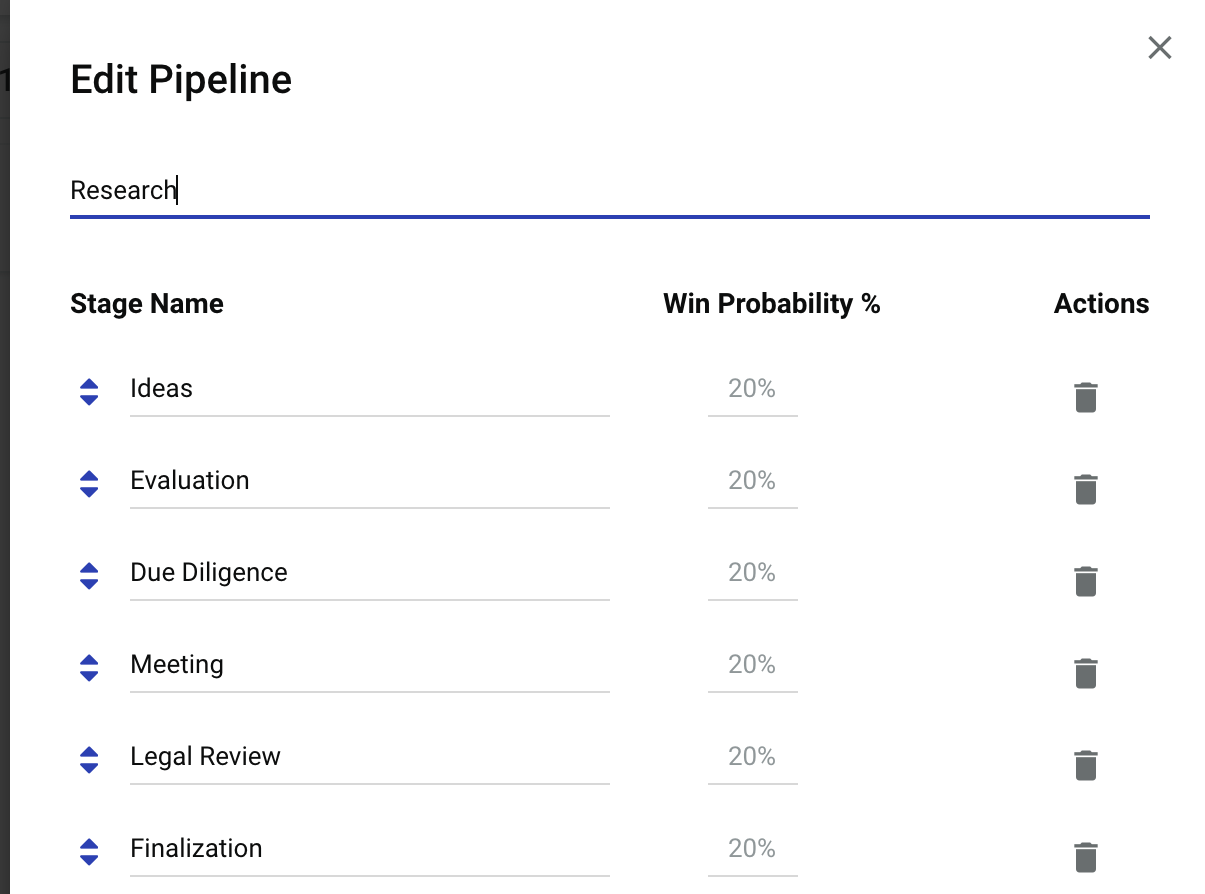

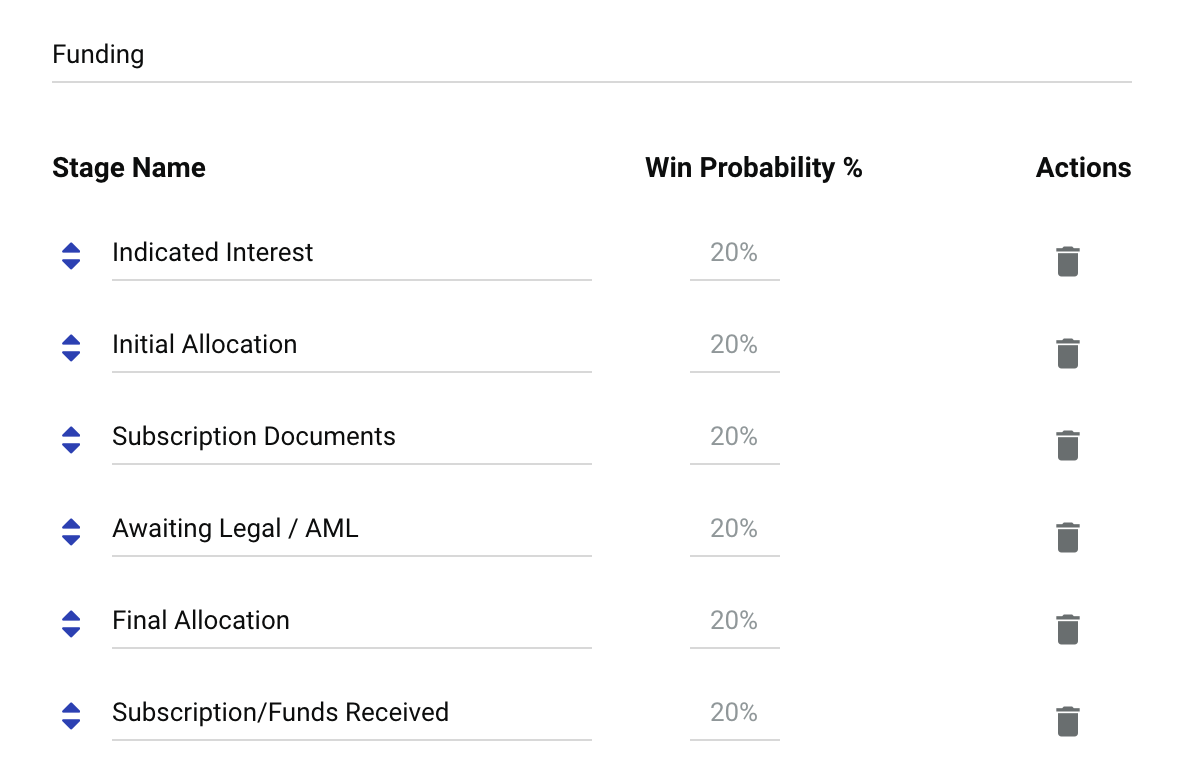

Our multiple pipeline recommendation for VC firms looks something like this:

1. A Research pipeline to keep track of ideas or companies the firm would like to invest in. To configure this pipeline, take the current research process and replicated it into stages.These stages move from the Ideas stage into evaluation of the idea, to the lengthly due diligence stage. What follows is a meeting, legal review and the finalization of the investment.

Projects is a great alternative for this process if you do not have values attached to your ideas.

2. A Fund pipeline to ensure investors have funded your investment. Opportunities in this pipeline represent entities who express interest in working with your firm. Tracking subscription documents are also of interest here, as well as outstanding legal documentation. Stages may include Initial Allocation to identify accepted investors, Subscription Received to track completed documents, and Awaiting Legal Documents / AWL to ensure follow ups to ensure nothing slips through the cracks before the final allocation. We recommend using the Docusign integration for legal contracts, or attaching legal Files to the related section on your Opportunity records.

3. Lastly (and our personal favorite) is the relationship building pipeline. This pipeline is very similar to our recommended business development pipeline. The relationship building pipeline tracks how well the team is connecting with prospective clients and casting a wide networking net. We keep the stages short and sweet: initial outreach, interest, first meeting, final meeting. To report on relationship efforts, your firm can leverage the “activity by user” report to better understand which team members are most efficient in building strong partnerships.